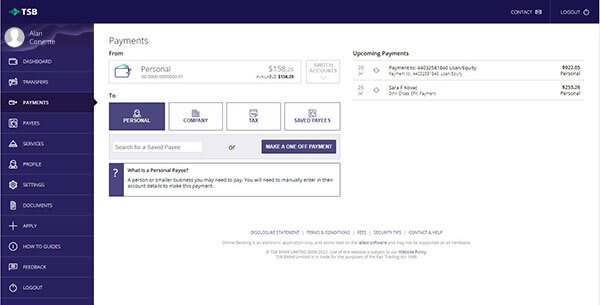

How to make payments to new and saved payees

Pay someone

Pay a personal payee

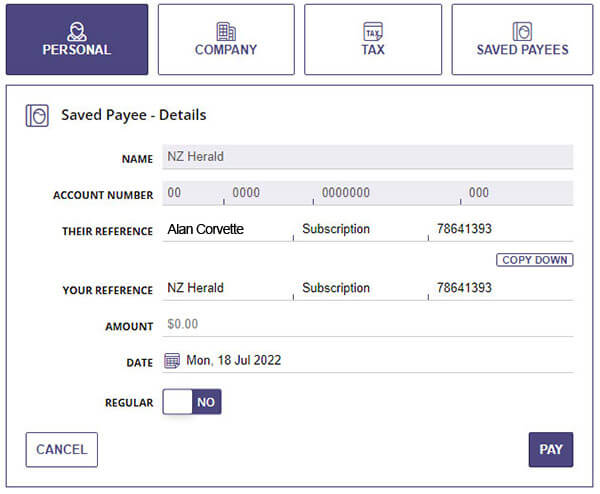

Use this guide below to pay a saved personal payee who is a person or small business whose details you have saved previously.

- Go to Payees on the left menu

- Select the account to make a payment from

- Begin typing the name of the payee in the Search for a Saved Payee box

- Select the name of the payee

- Enter the payment details

- Select the frequency of the payment

- Click PAY to make the payment

- You may be asked to authenticate

- Click CONFIRM to complete the payment

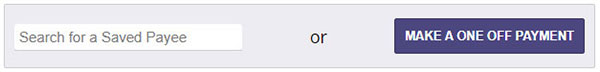

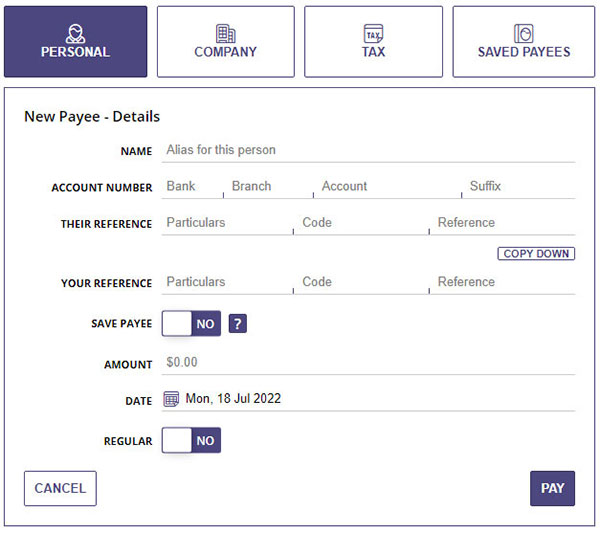

Make a one-off payment

Use this guide below to pay a person or small business whose details have not been saved.

- Go to Payments on the left menu

- Select the account to make a payment from

- Click Make a One Off Payment

- Enter the payment details

- Select the frequency of the payment

- Click PAY to make the payment

- You may be asked to authenticate

- Complete the payment by clicking CONFIRM

Pay a company

Pay a saved company payee

Use this guide below to pay a saved company payee below whose details you have saved previously.

- Go to Payments on the left menu

- Select the account to make a payment from

- Click Company

- Begin typing the name of the company payee in the Search for a Saved Payee box

- Select the frequency of the payment

- Click PAY to make the payment

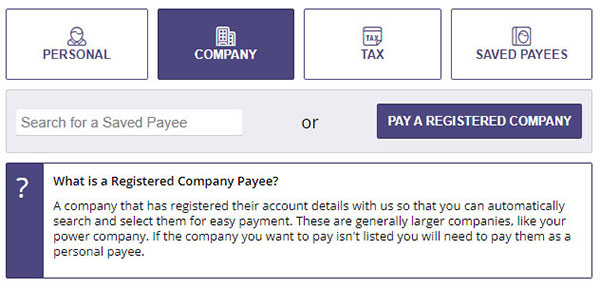

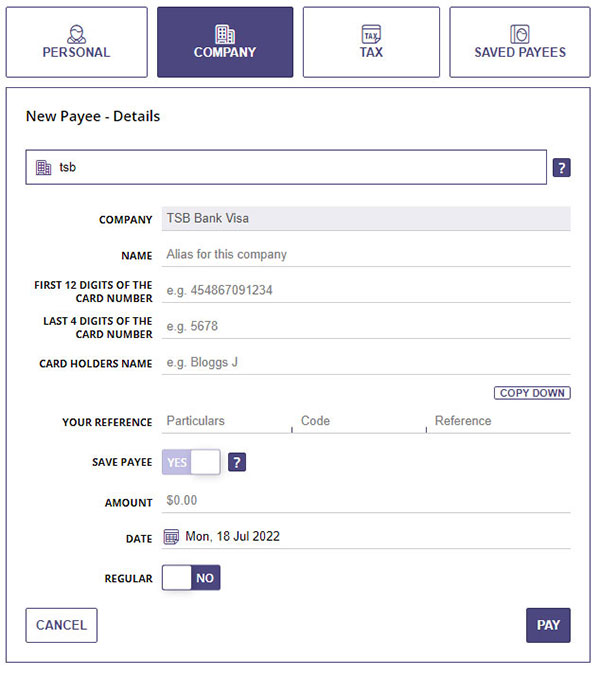

Pay a registered company

Use this guide to pay a company that have registered their account details with us so you can automatically search and select them for easy payment.

Please note: Registered companies are generally larger companies, such as your power company. If the company you want to pay isn?t listed, you?ll need to pay them as a personal payee.

- Go to Payments on the left menu

- Select the account to make a payment from

- Click Company

- Select pay a registered company

- Type the name of company you want to pay and select it from the list below

- Enter the payment details

- You will have the option to save the payee

- If the payment needs to be made more than once, click regular and select frequency

- Click PAY to make the payment

- Complete the payment by clicking confirm

Pay Tax

Use this guide to either pay a saved tax payee or to make an IRD payment.

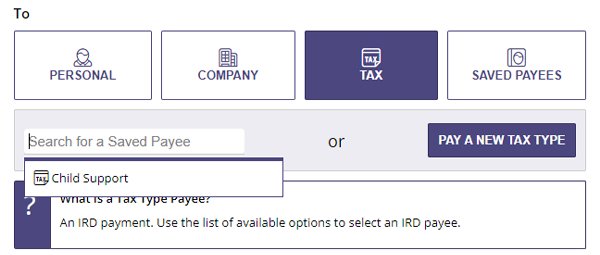

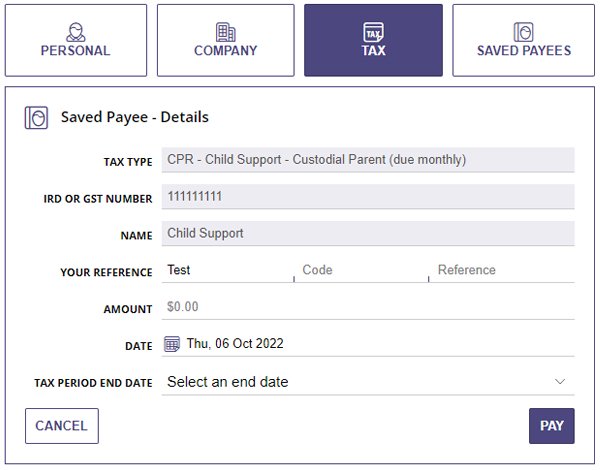

Pay a saved tax payee

- Go to Payments on the left menu

- Select the account to make a payment from

- Click on Tax

- Begin typing the name of your saved tax payee in the "search for a saved payee" box

- Enter the payment details

- Click PAY to make the payment

- Complete the payment by clicking confirm

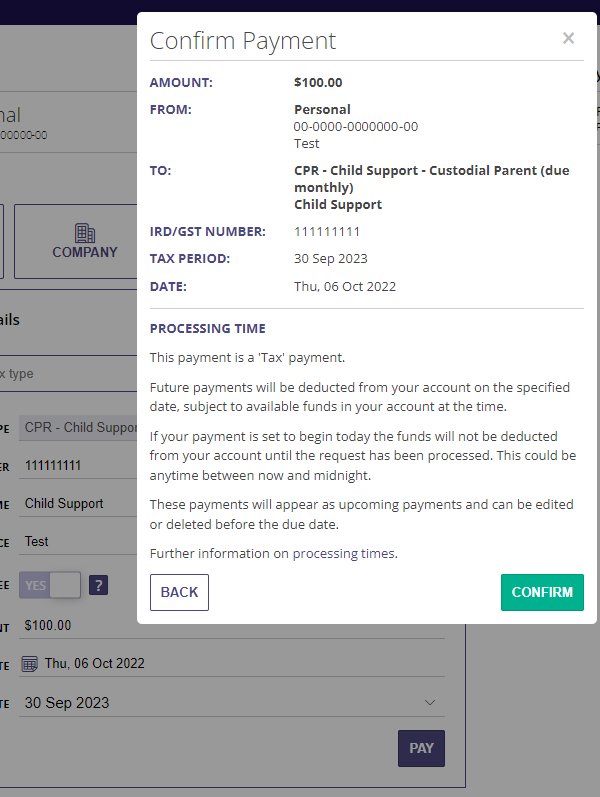

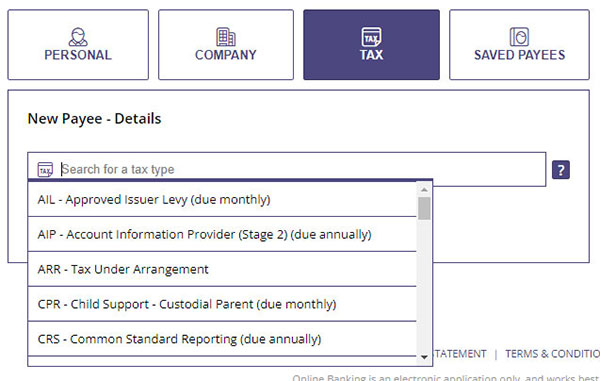

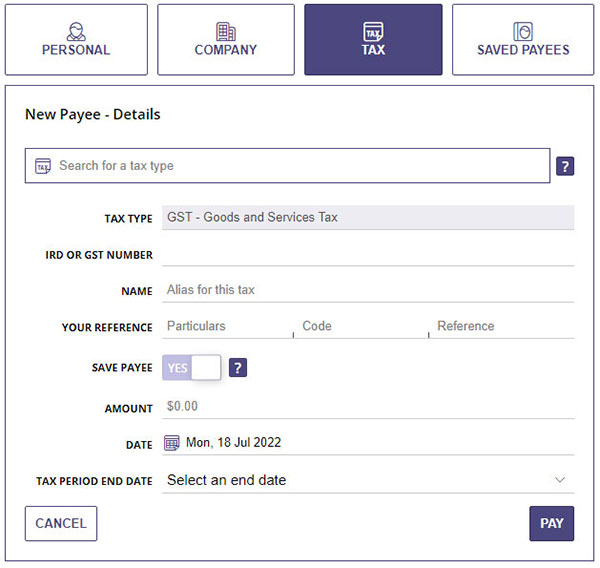

Pay a new tax type

- Go to Payments on the left menu

- Select the account to make a payment from

- Click on Tax

- Click Pay a new Tax Type

- Type the name of Tax you want to pay and select it from the list below

- Enter the payment details

- Select the date the payment needs to be made

- You'll have the option to save the payee

- Complete the payment by clicking confirm

If you require further assistance, give our team a call on 0800 872 226 or visit your local branch.